Private Equity Pitchbooks – the most frequently used tool in the fundraiser’s kit

Investment management firms of all stripes rely heavily on one document through the course of a capital raise: the trusty investor presentation. These decks are typically 15-40 slides in length, created in Microsoft PowerPoint, and make for a rather unexciting read. Yet, they are creating hundreds of impressions in the minds of individuals who invest or work within institutional Limited Partners.

At Darien Group, we believe the high visibility and frequency of use of these documents create an imperative to raise the bar on all fronts. Your firm’s pitchbook should carry the fund’s strategy and story in the most compelling possible manner; information should be organized and sequenced in accordance with presentation best practices; and graphic design should be optimized despite the aesthetic limitations of PowerPoint.

How to optimize the story of your fund

Sometimes just having a well-informed third party read your materials, hear your pitch, and provide critique can be revelatory in pointing out opportunities for improvement and clarification. Darien Group has worked on over 200 client pitchbooks in the past eight years; our team has a strong sense for what aspects of a narrative stand out versus those that blend in or are more commoditized. Following research and discovery sessions, we prepare a Content Advisory Presentation during which we deliver our recommendations, both overarching and slide-by-slide, for our clients’ reactions and/or approval.

Private Equity Pitchbooks – what are ‘Presentation Best Practices’?

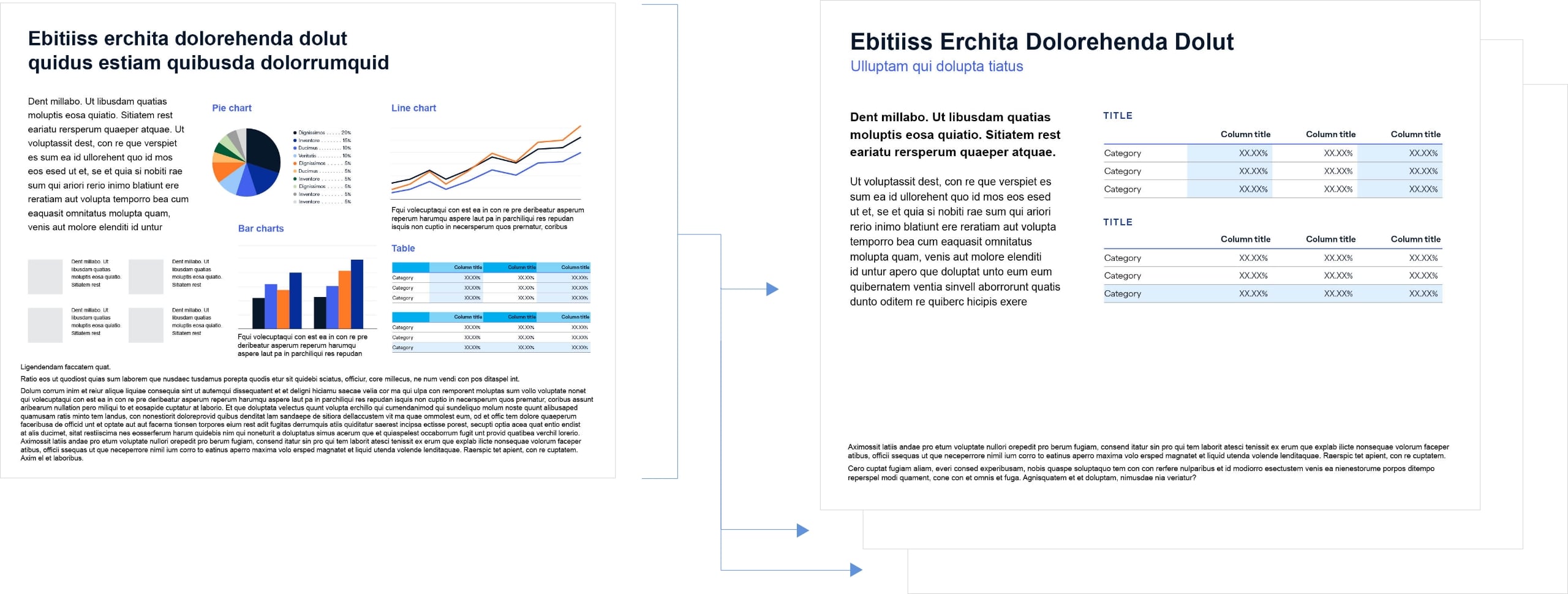

Through our extensive work in the presentation medium, we’ve identified a set of best practices that help to deliver the key messages regarding your fund’s value proposition in the clearest, most succinct way possible. (You can read about some of these in our Pitchbook Best Practices content series.) In the broadest terms, we tend to attempt to reduce word count and to ensure that each slide is not trying to accomplish four things at once.

Even today, prevailing private equity presentation templates bear the DNA of where they originated: investment banks. These decks tend to be overstuffed with information; too much data is one thing, but an overload of paragraphs and bullet points will frustrate even the most dedicated reader.

Finally, we must acknowledge that pitchbooks’ most frequent usage is not to be flipped through page-by-page during a meeting with a prospective LP. These documents are sent ahead as teasers, left behind following a meeting so that an individual might socialize them with colleagues, or planted in a data room. As such, a pitchbook must serve both purposes: sufficiently standalone to be read by the uninitiated, but not so dense as to compete for attention with a live fundraising team member.

But can you make it look good?

Were we permitted to create investor presentations in the Adobe software suite, they might be awardworthy in their aesthetic brilliance. However, the practicalities of most fundraises prevent this. Pitchbooks are edited throughout a fundraise, often by several (or several dozen) client team members, and so we must revert to PowerPoint for its wide adaptation throughout the financial services industry.

Within that restriction, though, Darien Group’s graphic design team does an exceptional job bending the rather rigid software to create the best-looking decks your LP audience has ever seen. (We will at the very least get you placed in the top decile.) This visual cleanliness will connote to your readers a sense of organization and diligence, a positive compliment to the fund performance you’ve worked so hard to achieve.

Finally, Darien Group believes there is inherent benefit to hiring graphic designers to do graphic design work. It is generally faster and less expensive than tying up internal resources whose attention is better turned toward core Investor Relations duties than attempting to align charts with slide titles. Plus, this work might be a good entry point toward other deliverables – a PowerPoint template for use across your organization, or longer-form content such as PPMs and ESG Reports.

Investor presentation resources

For more details on our approach to Investor Presentation strategy, design, and development, read relevant articles here in our Resource Center.